🧱 How the Managing Partnership Works

This isn’t a handout. It’s a system.

The Managing Partner Split is Winthrop Capital’s equity model designed for volatility. It’s not about promises—it’s about proof. Here’s how it works:

🔓 You Own from Day One

You step into equity immediately—no vesting cliffs, no waiting periods.

Your stake is real, documented, and tied to performance—not politics.

📈 We Share the Upside

As the business grows, your equity grows. Simple.

Our model rewards execution, not speculation. You’re not betting on hype—you’re building on cash flow.

🛡️ Risk Is Distributed, Not Dumped

We don’t offload risk onto partners—we share it.

Our structure is designed to absorb shocks: tariff hikes, inflation swings, legal rulings. You’re not exposed—you’re insulated.

🧠 It’s Engineered for Resilience

The split is part of a larger system: acquisition scripts, deal analyzers, lender-ready docs, and pre-IPO stock access.

You’re not just buying into a business—you’re entering a system built to outperform in chaos.

🧭 Why It’s Different

| Traditional Equity | Managing Partner |

|---|---|

| Delayed vesting | Immediate ownership |

| Speculative upside | Cash-flow driven growth |

| Risk dumped on buyer | Risk shared and shielded |

| No macro strategy | Built for volatility |

“In a world where tariffs spike overnight and court rulings can erase a trillion dollars in trade, equity isn’t just a percentage—it’s protection.”

Sample Deal Available

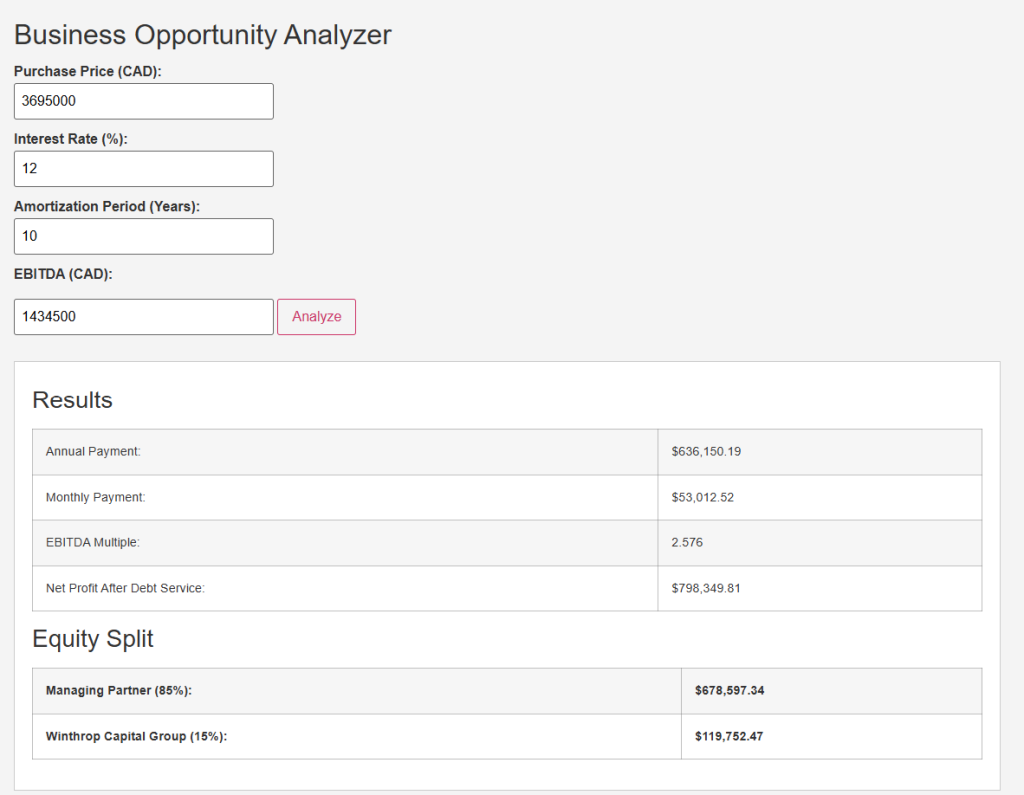

This could be your story! A $3,695,000 Sales Price. Your share after debt service – $678,597.34 annual Income all for a small fee to Winthrop Capital Group. Call WL Laney @ 602-684-7170 for more Info.

🚀 Winthrop Capital: First Acquisition Launch Sequence

Step 1: Orientation & System Activation

Receive access to the full Business Acquisition Mastery Suite: books, training videos, scripts, deal analyzers, and equity brief.

Review the Managing Partner Split structure and confirm initial equity terms.

Activate your Winthrop System Blueprint—a step-by-step guide to acquisition execution.

Step 2: Identity & Positioning

Craft your Managing Partner Profile using our templates—credibility-first, lender-ready.

Deploy branded messaging that dramatizes your system, not your lifestyle.

Use our Objection-Handling Scripts to neutralize skepticism and build trust.

Step 3: Deal Targeting & Filtering

Access our Vetted Deal Pipeline or plug into your own lead sources.

Use the Business Opportunity Analyzer to evaluate deals based on cash flow, leverage, and acquisition fit.

Apply the 100% Down Strategy logic—double escrow, stock loopback, and lender alignment.

Step 4: Strategic Outreach

Send LOIs (Letters of Intent) using our pre-built templates tailored for credibility and flexibility.

Use Equity Split Visuals and Stock Subscription Agreements to dramatize your offer.

Engage sellers with confidence—your system speaks louder than your resume.

Step 5: Lender & Legal Alignment

Present your acquisition using our Lender-Ready Deck and Stock Option Brief.

Align with vetted lenders who understand the Winthrop model.

Use our Legal Templates to finalize terms, equity splits, and closing mechanics.

Step 6: Close & Operationalize

Finalize acquisition with support from our Closing Checklist and partner network.

Step into ownership with operational scripts, cash flow dashboards, and equity tracking tools.

Begin onboarding additional partners or scaling through second-tier acquisitions.

🧭 Optional Add-Ons

Pre-IPO Stock Access for qualified partners

Equity Syndication Tools for multi-partner deals

Visual Metaphor Assets for web, pitch, and investor decks